As global interest rates continue to rise, Bangladesh faces a considerable increase in its foreign debt servicing liabilities.

To compound the challenge, an internal calculation by the Economic Relations Division (ERD) reveals that the government is expected to see a $1.5 billion decline in net financing from external sources next fiscal year and $2 billion the following year.

Experts said this double blow threatens to shrink the government’s spending capacity, posing significant obstacles to its ability to allocate funds effectively.

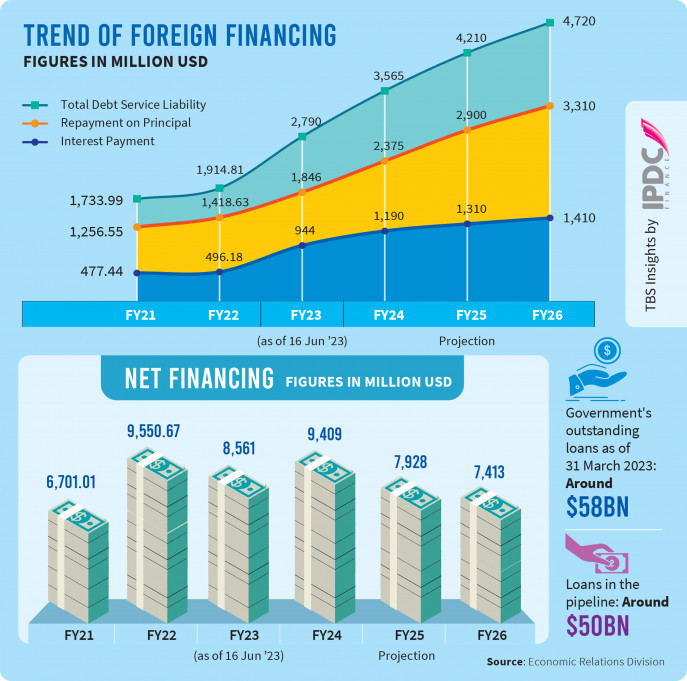

ERD data, seen by The Business Standard, indicates that Bangladesh’s interest payments on foreign loans in FY24 are projected to exceed $1 billion, for the first time in the country’s history, compared to just $496 million two years ago.

Taking into account the principal amount, Bangladesh is obligated to pay a total of $3.57 billion (Tk37,128 crore) to its foreign debtors in the current fiscal year.We won’t go far without FDI

The amount is almost equivalent to the country’s health budget and more than Tk34,722 crore earmarked for the current fiscal year for the primary and mass education ministry. Also, the figure exceeds the money spent by the government for the construction of the Padma Bridge.

According to ERD estimates, repayments for foreign loans and interest are anticipated to exceed $4 billion over the course of the next two fiscal years.

Though net financing will increase in the current financial year on the back of higher disbursements and lower repayment pressure, it is projected to decline to $7.4 billion in FY26 from $9.4 billion this fiscal year, posing a fiscal challenge for the government.

ERD officials said that due to the impact of the Russia-Ukraine conflict, the secured overnight financing rate (SOFR) has increased, leading to a rise in market-based foreign loan interest rates.

The current SOFR stands at 5.05%. After adding the spread, Bangladesh has to pay an interest rate of 6% to 7% for foreign loans. As a result, the pressure to repay the interest has increased, they said.Subsidy, interest payment to go high in FY24 budget

Dr Zahid Hussain, former lead economist of the World Bank’s Dhaka office, said the market-based lending rate was less than 1% or close to zero even two years ago. During that time, both the government and private institutions took a lot of loans from the international market.

“The grace period of many of the loans that have been taken in recent times have not ended. Interest payments are increasing mainly for loans taken earlier. Because the SOFR rate has increased and variable speed has been added,” he said.

“As these loans have already been taken, we have to repay them. There is no other option but to increase the fiscal space. Another option is that the loan agreements can be renegotiated. It is possible to do this for many loans after a certain period of time,” the eminent economist stated.

Dr Zahid Hussain further said, “We have to renegotiate the loan agreement and decide whether we will stay with the variable interest rate or move to the fixed interest rate. There is also an option to repay the entire amount. But it is not possible to pay the full amount amid the dollar crisis.”

He added that due to the global situation, it would not be wise to expect interest rates to decrease in the next two years. However, it can be projected that the trend of increasing interest rates will stop at the end of the current financial year.Forex reserve falls below $30bn again after ACU payment

Ahsan H Mansur, director of the Policy Research Institute of Bangladesh, said that Bangladesh’s foreign debt has increased along with market-based debt.

He noted that interest rates have increased in the international market recently, and there is no sign of this trend abating. As a result, the cost of repaying loans will increase, which is natural.

However, he pointed out that Bangladesh’s foreign debt to GDP ratio is still very low.

Ahsan H Mansur also said that fixed interest rates are gradually increasing. This means that debt is becoming more expensive. Therefore, he advised that loans should only be taken for good projects that will generate returns.

According to the ERD, the government will have to make $1.19 billion in interest payments on development project loans and budget support loans in the current fiscal year.

ERD projections indicate that in the 2024-25 FY and 2025-26 FY, the interest payments will increase to $1.31 billion and $1.41 billion, respectively.

Earlier, in the 2021-22 FY, Bangladesh made interest payments of $496 million on its debt. Based on the data available as of 16 June 2023, interest payments on external debt for the 2022-23 FY were projected at $944 million.

The ERD has further highlighted that not only will interest payments increase but also the principal payments will surpass $3 billion annually within the next two years.

In the 2021-22 FY, Bangladesh repaid $1.418 billion in principal on loans to development partners. It was $1.846 billion in the 2022-23 FY as of 16 June 2023, which could rise to $2.37 billion in the current fiscal year.

Expiration of the grace period on several major projects will result in principal repayments of $2.90 billion and $3.31 billion respectively in the next two fiscal years.

$4 billion in interest and principal payments next fiscal year

According to ERD data, the total estimated amount to be paid in the current fiscal year, including principal amount and interest, is $3.565 billion.

However, the interest and principal repayments will exceed $4 billion in the next financial year. In 2025-26 FY, Bangladesh will have to pay development partners $4.72 billion in principal and interest.

As per the ERD, in 2021-22 FY, Bangladesh paid $1.914 billion in principal and interest payments. The amount was $2.790 billion in 2022-23 FY.

ERD officials said that the post-Covid-19 economic recovery and the situation caused by the Ukraine-Russia war have increased pressure on interest payments for Bangladesh, which has taken budget support from the Asian Development Bank (ADB) and the Asian Infrastructure Investment Bank (AIIB) at the SOFR rate.

The budget support has increased pressure on interest and principal payment of loans to development partners. In addition, the grace period for loans taken for several major projects is ending in the current financial year, which means that principal payments for these loans must be made in these projects, they said.

Net financing to drop

The ERD report predicts that net foreign financing will increase in the current year, but will decrease in the next two years.

Net financing is calculated by subtracting the principal amount from the foreign loan disbursement.

According to ERD data, net financing will increase in the current financial year to $9.409 billion, from $8.561 billion in the previous year. Net financing is expected to decrease in the next two financial years to $7.928 billion and $7.413 billion, respectively.

Foreign loan disbursement crossed $10 billion for the first time in 2021-22 FY, and the ERD expects this trend to continue. Foreign loan disbursement is projected to reach $11.784 billion in the current financial year. Although the amount will decrease in the next two financial years, it will remain above $10 billion, as per the ERD.