As millions of Americans head to the polls on November 5 to vote for either Democratic Vice President Kamala Harris or her Republican rival Donald Trump, apparel business communities in Bangladesh, more than 13,119 kilometres away from Washington, will be watching the results of the presidential election closely.

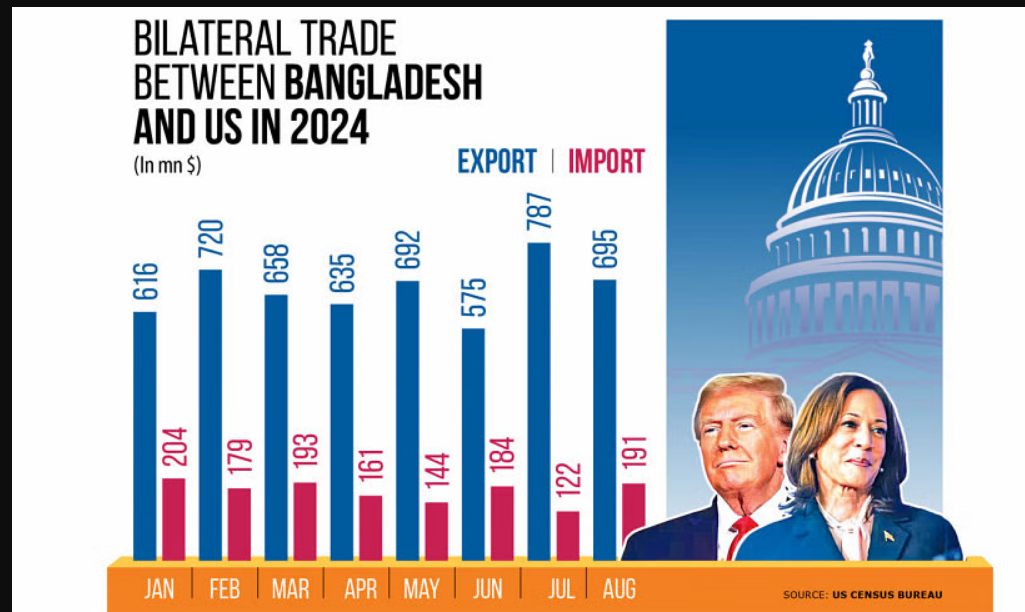

The reason is largely related to trade, as the US is the single largest buyer of ready-made garments made in Bangladesh — the world’s second-largest apparel manufacturer after China.

Local RMG makers believe US trade policy toward China, a major competitor in the global apparel market, will be crucial for their business in the coming years.

Besides, the role of the World Trade Organization (WTO) and other global trade organisations will be important as Bangladesh transitions to a developing country in 2026.

Apparel exporters say Republican Candidate Trump’s plan to impose higher tariffs on imports from China could boost Bangladesh’s garment exports.

But, they fear that a Trump presidency could also lead to challenges for multilateral trading institutions like the WTO and intensified global export competition.

Last year, Bangladesh exported $8.27 billion worth of garment items to the US, facing a 15.62 percent tariff.

Under both Democratic and Republican administrations, garment exports from Bangladesh to the US have remained relatively stable.

During Trump’s presidency from 2017 to 2021, Bangladesh’s share of garment exports to the US fluctuated between 17 percent and 18.90 percent, according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Under Democratic President Joe Biden, the share has not increased too much, varying between 21.15 percent and 18.12 percent.

Asking not to be named, a renowned garment exporter to the USA from Bangladesh said Trump’s anti-China move could eventually benefit Bangladesh. If he imposes more tariffs on Chinese products, there is a possibility of work orders shifting to Bangladesh.

Khandoker Rafiqul Islam, immediate president of the BGMEA, said Trump’s additional tariff on Chinese goods plan has already prompted many US-based clothing retailers and brands to look for alternative sourcing destinations such as Bangladesh and Vietnam.

“If Harris is elected, it is expected that the existing US tariff will continue for China. In this case, Bangladesh’s business may not be affected negatively but the possibility of an export jump is thin,” he said.

However, Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID), a private research organisation, said there could be a significant change in approaches between Trump and Harris.

For instance, if Trump is elected, multilateral institutions and organisations like the WTO may face challenges.

“Trump may adopt a more anti-China policy and impose more tariffs on import of Chinese goods to the USA,” Razzaque said, “In this case, Bangladesh may be benefited indirectly as there is a possibility of shifting of work orders from China to Bangladesh.”

However, an identified geo-political rivalry and undermining the fundamental multilateral trading system may result in a demand slump, he said.

The RAPID chairman said demand for garment items has been declining over the past three to four years and most G-20 countries, including the US, have adopted protectionist trade policies.

He said Bangladesh may face additional challenges when it graduates from a Least Developed Country (LDC) to a developing nation in 2026. Rules-based trade may be affected.

According to Razzaque, a Democratic administration could lead to less intense geopolitical tensions, possibly benefiting Bangladesh through the maintenance of the multilateral trading system.

However, he reminded that the US’s main interest remains containing China.

Masrur Reaz, chairman of the Policy Exchange Bangladesh, echoed Razzaque’s views.

Reaz said Donald Trump was aggressive in imposing tariffs on Chinese imports during his previous term. If re-elected, he may adopt an even more aggressive stance toward Chinese imports.

Bangladesh should also restart negotiations with the US to revive the Generalized System of Preferences (GSP) for US markets, as the relationship between the two countries is improving, said Reaz.

Since the expiration of the Multi-Fibre Arrangement in 2004, Bangladesh has not enjoyed any tariff preferences on garment exports to the US.

Before the Trump administration imposed a 25 percent tariff on Chinese goods in January 2018, Chinese exporters faced a 3.08 percent duty on garment exports to the US.

According to the Hong Kong Ministerial Declaration of the World Trade Organization (WTO), the US was supposed to provide duty-free market access for all products from LDCs. However, the US government granted duty-free access to only 97 percent of products.

As an LDC, Bangladesh’s garment exports were expected to be included in the 97 percent duty-free category, but apparel products were excluded from this package.