One fine morning Dipa, a millennial living in Dhaka, woke up to a clogged toilet. After getting the toilet fixed by requesting plumbing service through Sheba.xyz (online service market) Dipa rushed to work on a Pathao (ride-sharing platform) bike. She jump started the day by ordering a coffee on Hungrynaki (online food delivery company). Later that day after realizing that she forgot to buy bus tickets for her parents Dipa bought them through Shohoz (online ticketing service) and paid through bKash (mobile financial service). On her way home Dipa set a doctor’s appointment using Doctrola (online doctor’s appointment service). She ended the day by having dinner which was prepared with groceries bought through Chaldal (online grocery shopping).

The startup ecosystem in Bangladesh starting its journey in the early 2010s has experienced a remarkable transformation and is finally coming of age. At present, the number of startups stands around 1000+ and is estimated to grow multifold in tandem with the digital ecosystem. Around 63% of the Bangladeshi population is aged below 35[1] and with the internet, smartphone and social media penetration rates of 55%, 31% and 20% respectively, the market for technology-enabled services is set to grow.[2] Simultaneously, Middle and Affluent Consumers (MAC) will keep growing at a y-o-y 10%+ driving consumption.[3] Propelled by the healthy growth of digital enablers and the rising purchasing power of consumers the booming startup ecosystem is making the lives of thousands like Dipa’s easier each day.

How is the ecosystem developing?

The startup ecosystem which mainly formed around Dhaka and Chattogram has been growing on the back of sectors like IT, e-commerce and digital marketing. Gradually, the focus has been shifted to ride-sharing and logistics due to the rising consumer demand as well as recent investments received by industry players: Pathao (US$12 Mn from Go-Jek), Shohoz (US$15 Mn from Golden Gate Ventures), Deligram (US$2 Mn from Skycatcher). Fintech company bKash, with an active user base of 31 Mn and investment from Ant Financial, is changing Bangladesh’s mobile financial sector and encouraging new entrants. Driven by the recent shifts in technology and business processes the demand for online courses is growing — giving rise to Edutech startups.

To gain deeper understanding of the ecosystem, we interviewed founders and top management from 100+ startups across the industries from Dhaka and Chattogram. We asked them about the current and expected sentiment of their respective industries. Applying harmonized index formula, each industry has been scored on a scale of -100 to +100. The overall startup confidence index stands at +40 which indicates a positive sentiment. At the same time we asked investors to mention the top sectors they preferred based on current performance and future growth prospects.

Both the investors and startups have rated Fintech and Ride-sharing and Logistics as two of the most promising sectors. Healthtech and Edutech are esteemed to be on the forefront of the next growth. Despite investors’ high confidence in e-commerce sector and lucrative funds raised by Chaldal (US$5.5 Mn from International Finance Corporation), Daraz (acquired by Alibaba), Sindabad.com (US$4.2 Mn from Aavishkaar Frontier Fund), players are considering the sector as a low confidence one as the percentage of online purchase is still less than 1% of the total retail purchase regardless of the high disposable income and internet penetration rate.[4]

Who are the ecosystem builders?

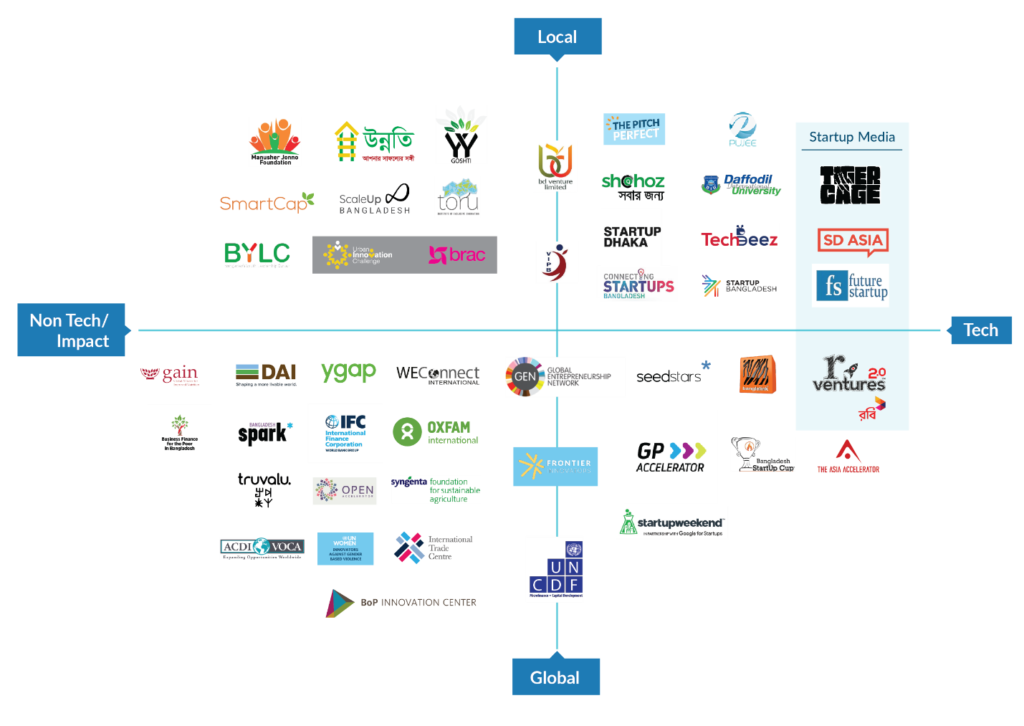

Bangladesh’s startup ecosystem has had a late start compared to its regional peers. However, the exemplary growth was possible due to the successful implementation of a number of countrywide incubators and accelerators programs. The global and local incubators and accelerators have been assisting entrepreneurs in aspects ranging from scaling up their ideas to raising funds and becoming sustainable in the long run. GrameenPhone Accelerator powered by Seedstars is one of the largest tech accelerator programs that has assisted successful startups such as – Sheba.XYZ (online service marketplace), CMED Health (A.I. enabled healthtech platform), Repto (online learning platform) among others to graduate. Since 2016, Banglalink incubator, in association with ICT Ministry, has been facilitating innovative ventures to grow further. Jeeon (m-health platform), ishkul (school management software), 6 Axis Technologies (personal and industrial robotic automation solution provider) are some of the most promising alumni graduating from the network. Robi Axiata Limited has recently launched R-Ventures (a reality show and investment platform) aiming to transform digital business ideas to a reality.

In recent years a significant number of local incubators and accelerators programs are coming up to guide both tech and non-tech startups. Startup Dhaka grabbed the attention from the global market with its flagship documentary in 2013 highlighting the promise of startups in Bangladesh. Tiger Cage, SD Asia and Future startups have been inspiring youths through their media presence to pursue an entrepreneurial career rather than waiting for jobs. Global players namely Truvalu, YGAP are running accelerator programs for Impact Enterprises. SmartCap – a platform by LightCastle Partners targeted at Impact Enterprises has run or supported more than 15+ accelerator programs till date. Mentoring entrepreneurs, facilitating access to finance, creating market linkages are some of the focus areas of SmartCap.

Who are the investors?

The Angel market is growing rapidly in Bangladesh with presence of players such as -Bangladesh Angels, Pegasus Tech Venture, SBK Tech Ventures, Bangladesh Venture Capital among others. The angel’s network – a consortium of angel investors in the country has been working towards bringing together promising early stage startups to and introduce them to serial entrepreneurs, tech executives and investors. Majority of the angel investors are focused on tech startups at present which might shift to impact sector in the coming years.

Where is the ecosystem headed? Venture capital firms have been playing an integral role in building the startup ecosystem. Emergence of sector specific VC firms are helping startups targeted to serve niche market e.g. Ignite Impact Ventures is focused on social-impact oriented technology startups in frontier market.

Bangladesh, with a target to become the next Asian tiger needs to maintain a stable GDP growth with a healthy employment rate. Around 60 thousand students graduate each year and roughly 19% of them make it to a job.[5] Additionally, the plummeting growth of Ready-made Garments (RMG) sector is signaling major job loss for blue-collar workers. Expanding private sector especially the SME/Startup business segment can be one of the most effective solutions for keeping the economy thriving.

Startups in Bangladesh, despite of being the most potent engine for growth, face challenges in three levels. Firstly, the absence of proper mentorships and access to funds make it difficult for early stage startups to escalate. Through proper implementation of accelerator and incubator programs and circumvention of capital needs through investors’ network, this challenge can be addressed. Secondly, due to market malpractices (e.g. lobbying, using speed money, bad payment terms), the financial cost rises manifold resulting in closing down of ventures at an early stage. Lastly, the older generation have a negative outlook towards entrepreneurship and assume that one only does business if one fails to get a respectable job. Therefore, younger generation often prefer waiting to get a job rather than creating it.

Our interviews with startup founders and top management revealed that 32% of them had positive sentiment about the ecosystem development while 27% had negative sentiment. One founder said “the ecosystem will not gain enough traction unless there is a continued series of startup success stories. In order to become a success story one must complete the full circle which means graduating from the startup phase.” Another said “In the next 6 months to one year, a tectonic shift will happen in the ecosystem and local investors should prepare themselves to accommodate the change.” One founder added that the ecosystem is enabling only for early stage startups but not for those requiring more investment.

Bangladesh was ranked 116th out of 126 economies in the Global Innovation Index 2019.[6] Although the economy has been performing well compared to its regional peers, in terms of innovation Bangladesh got the lowest rank which indicates the lack of investment in areas such as – research and development, infrastructure, knowledge creation and diffusion among others. Having one of the most inefficient regulatory structures, Bangladesh ranked 176th out of 190 countries in the Doing Business Index.[7] Nonetheless, all these adversities could not prevent Bangladeshi entrepreneurs from raising multi-million-dollar funds, nor discouraged foreign investors to enter the market. Moreover, local ride sharing platform – Pathao extended its operation to Nepal in October, 2018 as the first Bangladeshi startup.

In 2018, Bangladeshi startups raised around US$27 Mn while Indian startups received US$4.2 Bn in funding.[8] The discrepancy between two markets with similar digital ecosystem depicts the absence of an enabling environment. Factors such as – accelerator and incubation programs, mentorship and training, availability of funds in the market will not be enough to bridge that gap. The entire business environment needs to transform in a way that it facilitates the growth of startups. Although our startup ecosystem has come a long way since its inception, it has a long path ahead to finally come of age.

This article was written by Silvia Rozario, Business Consultant, and co-authored by Mohammed Shehab, Business Analyst at LightCastle Partners. Interviews and Data Collection were done by Asif Newaz, Business Analyst at LightCastle Partners. For any queries, you can reach us at silvia.rozario@lightcastlebd.com.

References

- World Population Prospect 2019, United Nations Population Division, 2019.

- Digital 2019 Bangladesh. Hootsuit, We are social, January 2019.

- Bangladesh: The Surging Consumer Market Nobody Saw Coming, Boston Consulting Group, 2015.

- Unleashing E-Commerce for South Asian Integration, World Bank Group, 2019.

- Bangladesh Development Update: Regulatory Predictability Can Sustain High Growth, The Word Bank, October 2019.

- Global Innovation Index 2019, Cornell University, INSEAD, World Intellectual Property Organization (WIPO), 2019.

- Doing Business 2019, World Bank Group, 2019.

- Indian Tech Startup Ecosystem: Leading Tech in the 20s, NASSCOM, 2019