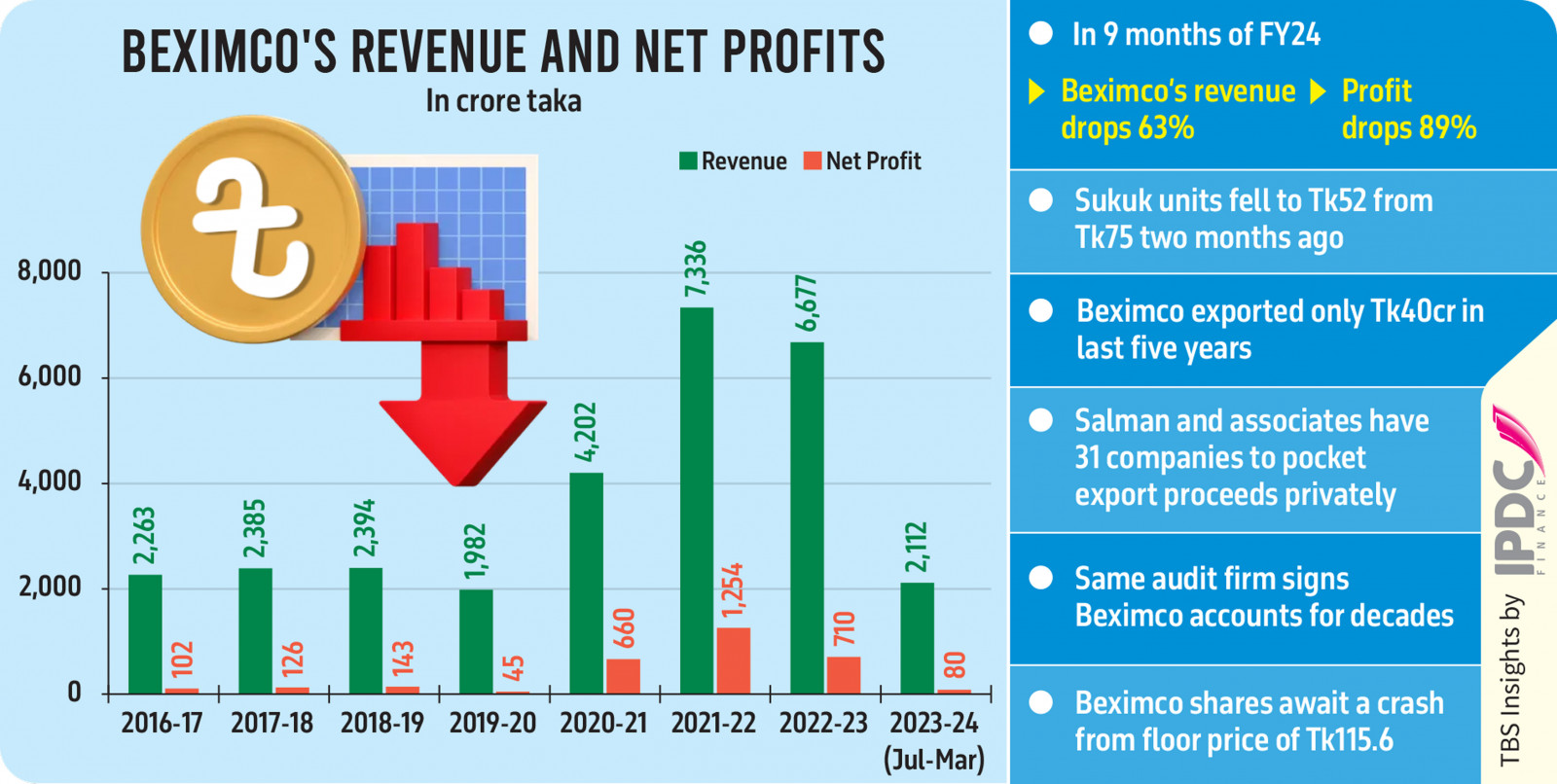

It may seem that detained tycoon Salman F Rahman’s flagship company, Beximco Limited, which primarily operates in textiles, discovered Aladdin’s lamp in 2021-22, with revenue skyrocketing from Tk1,982 crore to Tk7,336 crore in just two years.

In that year, Beximco launched the first Sukuk bond—an Islamic asset-backed borrowing instrument—to finance its 200MW Teesta Solar Power project, a 30MW solar plant, and additional textile machinery.

Analysts now believe that Salman’s aggressive promotion of Beximco’s impressive performance and stock rally worked to attract Sukuk investors.

After he managed to raise Tk3,000 crore through Sukuk at the end of 2021, Beximco’s miracle started to fade away and the company’s sales, and profits collapsed even before his world collapsed with that of the Hasina regime.

Showing a moderate slide in FY23, Beximco in the first nine months of the FY24 posted 63% drop in revenue and 90% fall in profits. Stock price which was pushed to over Tk180 from Tk14 in 26 months, now awaits a crash from the artificially held floor price at Tk115.6.

Hype and tricks

Over the period of 2020-22, Beximco Limited chairman in his statements to shareholders were talking about exports growth and further upsides that should be fuelled by PPE potentials to allure investors.

The statements, however, neither disclosed how much of its revenue was coming from which segments—textile, IT, Engineering and others, nor the breakdown of its exports or local revenue; data publicly traded conglomerates do disclose the details including ACI Limited.

Salman’s generic claims of big exports like $400-500 million a year, lacking transparent and detailed disclosures by Beximco Limited for letting investors know how much of the growth story is theirs, was always suspect to intelligent investors.

Beximco Limited, amalgamating many companies over years, has got a complex structure and without segmental breakdowns its reporting is non-transparent, said Chartered Financial Analyst Md Moniruzzaman, a former vice president of the Bangladesh Merchant Bankers Association.

“We, as analysts, have learned to raise red flags against listed companies having multiple entities of sponsor-directors for similar businesses. It risks making general investors susceptible to the wishes of the entrepreneurs whether they want to make public investors a gainer or loser,” he added.

Customs assessed value of all the exports by Beximco Limited was less than Tk40 crore for the period of 1 July 2019 to 30 June 2024, raising eyebrows of investors who were reading the company chairman’s optimism regarding exports.

Only 57 export consignments out of the group’s thousands over the period was by Beximco Limited. TBS found that Salman and his associates already owned at least 31 apparel exporting entities having membership of BGMEA to privately pocket export proceeds.

Thirty of the private companies are registered from their factory addresses at Sarabo, Kashimpur, Gazipur where Beximco Industrial Park is situated.

The CID on 18 September filed 17 cases against 28 persons including Salman F Rahman for alleged money laundering worth $83 million through 17 of such entities, while Beximco officials claimed the firms’ $135 million export bills were stuck with the foreign buyers due to their unwanted financial hardship and the buyers already paid over $50 million back in tranches.

When contacted, Beximco Limited’s Managing Director Osman Kaiser Chowdhury told TBS, Beximco Limited mainly owns the textile wing of the group, not the apparel arms that export readymade garments. Textile division’s exports are considered as deemed exports.

Export success determines the fate of the backward linkage industry that makes clothes, he said, adding that Bangladesh was doing great in apparel exports during the pandemic and the Ukraine war-sparked economic crisis that followed the pandemic impacts on foreign buyers together dragged the Beximco business again.

When Bangladesh reported a 2.8% growth in apparel exports in the first nine months of FY24, the Export Promotion Bureau data was announced to have been inflated, it is being expected that there might have been a moderate fall year-on-year.

Beximco Limited’s 63% decline in consolidated revenue, despite the newly added solar power revenue of several hundred crore taka, was the biggest shock to its investors.

Beximco Company Secretary Asad Ullah blamed the post-covid and Ukraine war-sparked crisis for the drop in business and said, “In tough times, push for growth might bring worse results.”

“Salman’s desperation for Beximco Limited’s rosy picture then and its stock rally is clearly understandable now,” said stock market expert Al Amin, an associate professor of Accounting and Information Sciences at the University of Dhaka.

The Dhaka Stock Exchange (DSE) surveillance report, ignored for long by the BSEC under the chairmanship of Salman’s ally Shibli Rubayat Ul Islam, revealed how Salman used his shell companies and associates to push Beximco Limited stocks sky high and cash in the windfall.

Also, a high price of the stock has been important for Salman to allure and rake in the Sukuk investors to finance his Solar projects that the last Hasina government awarded with the highest power tariff of 15 cents per megawatt, said Al Amin.

“There I see no answer as to why the government has to buy electricity at such an astronomical price while it buys power from other similar plants at around 10 cents, even which is higher than that in most peer economies,” he added.

Same auditor for decades

Surprising to all, Beximco Limited has been using only one auditor M J Abedin and Company, chartered accountants for decades without any break, while the Bangladesh Securities and Exchange Commission (BSEC) prohibited annual statements signed by the same auditor for more than three years in a row.

Beximco filed a writ petition and secured a stay order long ago, said Beximco Company Secretary Mohammad Asad Ullah.

Chartered Accountant Hasan Mahmood, who vetted Beximco Limited accounts, told TBS, “The stay order allowed us to serve a client for a long time. Why should we lose a relationship with an old client?

“Why did not the BSEC contest enough in court?” he asked, instead of responding to the allegation of letting go ahead with anything the company wanted.

BSEC Director and spokesperson Farhana Faruki told TBS that the securities regulator, after the recent change in leadership, is working on such issues.

Salman’s muscle play

Concerned about Salman’s behaviour in financial markets, cautious institutional investors remained hesitant about Beximco’s soaring shares and high-yield Sukuk with equity conversion options. Allegations have emerged that many investors felt coerced into purchasing the Sukuk, lacking real choice in the matter.

Salman reportedly used Bangladesh Bank and BSEC to pressure banks into buying the Sukuk. After the fall of Hasina, City Bank MD Mashrur Arefin told TBS that his bank was compelled to purchase Tk300 crore worth of Sukuk against its will. This sentiment was echoed across various institutions.

A CEO from a leading brokerage firm recounted to TBS that they initially bought Beximco shares at around Tk20, believing them undervalued. As the price approached Tk100 in less than a year, they attempted to sell, only to be pressured by Salman and BSEC officials to hold onto their shares.

“We were forced to buy back the shares, and my company faced harassment over alleged political ties,” he said, requesting anonymity. Now, his firm and clients are trapped with significant investments in Beximco shares, unable to exit due to the floor price restrictions.

Hapless investors

Analysts believe the five-year Sukuk scheme was structured to benefit Salman F Rahman while putting investors at risk.

Under the Sukuk terms, banks could convert 20% of their principal into Beximco Limited shares annually at a 25% discount to the one-month average market price. For example, if Beximco shares averaged Tk 100, investors could buy them for Tk75.

This scheme’s surge in revenue and stock price relates to the equity conversion option. If share prices remain high during conversion, existing shares are diluted less. However, if prices drop, investors receive more shares, reducing sponsor-director control since Beximco’s sponsors own only 30% of the company.

Most investors were hesitant to convert their Sukuk into equity due to artificially inflated floor prices, which they believed did not reflect Beximco’s true value. They fear that once the floor price is lifted, shares could plummet below the 25% discount offered for conversion.

When launched, Sukuk offered a very attractive proposition with coupons payment of minimum 9 percent. Also, if Beximco ever gives a dividend higher than 9 percent, then 10 percent of that differential would be added to the coupon.

However, the whole idea of sukuk fell through because of the imposition of floor price, making the bond unviable for investors.

Beximco Green Sukuk Al Istisna units, initially valued at Tk 100, have since dropped to Tk 40-53 from Tk 75 at the end of July. Industry insiders claim Salman and Shibly orchestrated the issuance by pressuring the issue manager, trustee, and investors. Earlier this year, BSEC also approved Beximco for raising Tk 1,500 crore through another zero-coupon bond.

Iftaker Ahmed, a college teacher in the capital, now regrets his previous conversion decision as he fears the shares might cause his capital erosion after the floor withdrawal.

Investors like Iftaker still cannot believe that Beximco Green Sukuk Al Istisna units having a face value of Tk100 have fallen free to a range of Tk40-53 apiece, from Tk75 at the end of July.

Industry insiders allege that Salman, with Shibly’s help, pressured the issue manager, trustee, and investors to orchestrate the Sukuk issuance. Similarly, he forced the issuance of Amar Bond, transferring a Tk1,500 crore default risk to the Salman-controlled IFIC Bank. Earlier this year, BSEC approved Beximco to raise another Tk1,500 crore through a zero-coupon bond.

How to save the investors

Beximco Limited as a listed company is partly owned by Salman and his family and the majority is owned by general investors. Neither the company nor the Sukuk holders-owned assets should be vandalised, said Professor Abu Ahmed, chairman of the Sukuk’s Trustee Investment Corporation of Bangladesh (ICB).

The under construction 30 MW solar plant in Panchagarh, several Beximco Industrial park facilities faced arson and vandalism after the fall of Sheikh Hasina that cost the company several hundred crore, said Beximco officials.

“I urge you all to let every wrongdoer face the music, not their businesses.”

The 200 MW solar plant had a valuation of over Tk2,000 crore and it is believed to be much higher now after the appreciation of dollar and the land.

The solar power land is owned by the company, while textile machinery bought out of Sukuk is under the ownership of the Sukuk investors through the special purpose vehicle (SPV).

Abu Ahmed told TBS, the 200 MW power plant’s bills received from the government should suffice for the coupon payments and the trustee is receiving the bills now.

The trustee is trying to make Beximco transfer the land ownership to the SPV that can be given back to the company after full repayment, he said, adding that the trustee can sell off SPV owned assets in case of non-repayment by the company.

Sources said, Beximco violated the trust deed by not giving Tk5 crore every month in the sinking fund under trustee’s control.

A sinking fund is the money set aside or saved to pay off a debt or bond. A company that issues debt will need to pay that debt off in the future, and the sinking fund helps to soften the hardship of a large outlay of revenue.

Trustee is also trying to make regular payments to the sinking fund, said Abu Ahmed.

This instrument is the first Sukuk in the country’s private sector. If investors’ experience turn sour, this will not let the potential financial instrument flourish here, he said, declining to comment on if the capital utilisation followed the books or not.