Bangladesh is the 2nd largest Ready Made Garments (RMG) exporter in the world after China. About 83% of its export earnings are coming from RMG. Textile and Apparel sector’s, the lifeline of the economy, has contributed Tk 2, 513,471 million or 11.16% of Bangladesh GDP. About 20 million people are directly associated with the industry. It is clear that main driving force of country’s economy is this industry. Now Bangladesh is dreaming to have middle income country status by 2021, RMG will certainly play a crucial role in materializing the dream.

Reasons behind the success:

1. Quick return:

As per the information from factory owners, RMG is the only sector in Bangladesh where one can get back his investment by 3 to 5 years. The ratio of the return against investment is very high compared to other business or industry. RMG is a people oriented industry. Currently it has 4.4 million of employees (Source; BGMEA). So, it can generate a lot of employment opportunity for both skilled and unskilled people. Also the social recognition and honor is the main achievement of an RMG entrepreneur. Employment of huge number of people is a great motivation for the industry owners.

2. Huge market opportunities:

Recent export data shows that there is huge chance to grow more RMG business in Bangladesh. Bangladesh has 6.4% of market share where our main competitor china has 36.4% share. RMG export is increasing every year and our market share rose 5.1%, 5.9% & 6.4% through last 3 consecutive years (Source; BGMEA). Our main competitor China, the largest garments exporter of the world, is now losing its garment export for high production cost and short of skilled manpower. Its market share decreased to 36.4% (2016) from 39.3% (2015). There is huge gap in export value between China ($161 Billion) and Bangladesh ($28.67 Billion). It’s a great opportunity for Bangladesh to grab more market shares.

3. Abundant & skilled workforce:

The main strength for this business is available workforce. Labor cost is lowest in Bangladesh among the other competitors. Minimum wages in Bangladesh is $ 95 where China is $ 155, Cambodia $ 140, India $ 137, Vietnam $ 107. Skilled and relevant educated manpower is also increasing in this industry. There is around 37 public & private university and colleges which are producing textile graduates. There are 6 government textile institutes (under Bangladesh Technical education board) for creating diploma engineers for this industry. There are also good numbers of private institutes and polytechnics are generating skilled manpower in every year for this sector.

4. Strong backward & forward linkage:

Favorable government policy and bank facilities for raw material purchase are advantages for this business. There is so many backward linkage supporting industries established in the country. Now a day’s maximum raw materials are available in local market. Around 1430 textile mills are in operation. Capacity of yarn production is 2100 million kg per year. Capacity of fabrics production is 2800 million meters. 85% of knitted fabrics demand met by locally. (Source: Readymade Garment & Textile Industry in Bangladesh). Over last few years Bangladesh’s strength in producing cotton based yarn and fabric has increase significantly. Good numbers of plants are in the process now. Chinese and other countries are looking forward in Bangladesh to invest in fiber, fabric and other allied industries in Bangladesh.

5. Incentives:

Bangladesh government has decided to raise cash incentives for the readymade garment exporters to 4% from 3%, for markets other than the US, Canada, and the European Union for financial year 2018-19. This in an effort to diversify export destinations. Government is also encouraging to the entrepreneur by providing incentive on export earnings (7% for nontraditional or emerging market) and low taxing policy on the income.

6. Government cuts source tax:

The government has once again slashed tax at source to 0.25 percent from the existing 0.60 percent for exporting goods to give some relief mainly to the RMG exporters following the recent hike in the wages of garment workers. According to NBR order, banks will deduct the tax on export proceeds of knitwear and woven garments, terry towel, carton and accessories of garments industry, frozen food, vegetables, leather goods, packed food and any other items at the time of crediting the proceeds to the account of exporters.

7. Special economic/export processing zones:

EPZs in Bangladesh play a significant role in attracting foreign direct investment as well as in involving local investment, which jointly contribute to an overall increase in the country’s volume of exports and in its earnings of foreign exchange. Foreign exchange earned through exports by EPZ enterprises reduces deficits in the country’s balance of payments. A part of it is converted into local currency to be spent on procurement of goods and services from the local economy.

More than 30 countries including Japan, South Korea, Hong Kong, Thailand, Sri Lanka, China, Taiwan, Malaysia, Indonesia, Singapore, USA, UK, Australia, Canada, Germany, France, Italy, Sweden, Netherlands, Switzerland, India, and Pakistan have so far invested in different projects in the EPZs in Bangladesh. Readymade garments manufacturing units account for the largest number of units in the country’s EPZs.

Work on the 500-acre zone, dedicated for the industry in Mirsarai, is underway, promising to attract local and international investments and generate some 150,000 new jobs over the next two years. The establishment of the new economic zone at Mirsarai is indeed a great initiative, offering our RMG industry the opportunity to present itself in a new light to our customers and to show the world that Bangladesh is a world-leading garment resource to be reckoned with.

8. Income tax reduction:

Owners of the readymade garments factories will benefit the most from this new order since more than 83 per cent of the export items are the RMG products. The owners of general RMG factories will have to pay 12 per cent corporate tax, which is 10 per cent for owners of green factories until June this year. This new tax benefit will boost profits for the owners, who claimed this will be an incentive for the export sector, leading to an increase in exports.

9. Geographic & demographic advantage:

Geographically Bangladesh is located in an ideal place which is an additional advantage for international business. Our country has very convenient access to international seaports, air routes and others. It has 3 sea ports (Chittagong, Mongla and Payra), 3 international airports (Dhaka, Chittagong and Sylhet) and 22 land ports. Every year about 2 lacs youth are entering in job market in Bangladesh. 70% of Bangladesh population is under 40 years of age which gives huge work force availability. Most of these youth is educated.

10. Duty advantages in export destinations (GSP, GSP+, Duty free access):

Currently Bangladesh has become eligible to graduate to a developing country from a least developed one as it has met all the three criteria for the first time for getting out of the LDC bloc. Earlier as a Least Developed Country (LDC) Bangladesh is enjoying duty free market access or reduced tariff rate facilities for RMG export to many developed and developing countries in the world. Tax free facility in importing country is a great advantage for RMG exporters. Bangladesh is getting GSP (Generalized System of Preference) facilities in 38 countries including EU (28 Countries) and some other (10 countries) selected countries. EU countries are importing 90% of garments from Bangladesh. Buyers are planning to increase more sourcing of their target goods from Bangladesh. Booming Bangladesh, a country preparing to leave the LDC category, is a success story likely to inspire others.

11. Recognized hotspot for sourcing:

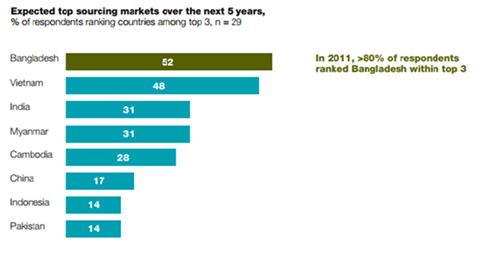

Bangladesh’s growth potential has been recognized by many reputed analysts across the globe. Goldman Sachs includes Bangladesh in the “Next 11” emerging countries to watch for along with the BRIC countries (Brazil, Russia, India, and China) and JP Morgan lists Bangladesh among its “Frontier Five” emerging economies worth investing in (Source: The Daily Star). Many research and survey showed that Bangladesh will be the next hot spot for sourcing. As per McKinsey & Company’s research; Bangladesh will be top sourcing country over next 5 years.

12. One of the safest RMG industries in the world:

Tajreen and Rana Plaza incident was a wake-up call for the entrepreneurs and all stakeholders. Though it was caused thousands of death but it made the owners, workers and all other parties involved with this business aware and now safety is being considered as integral part of the factories. Now Bangladesh factory is world standard in social compliance and workers safety. This awareness made our garment industry stronger and work friendly. Bangladesh has seen number of initiatives around Tajreen and Rana Plaza incidents i.e. Accord & Alliance altogether Bangladesh could use the learning positively.