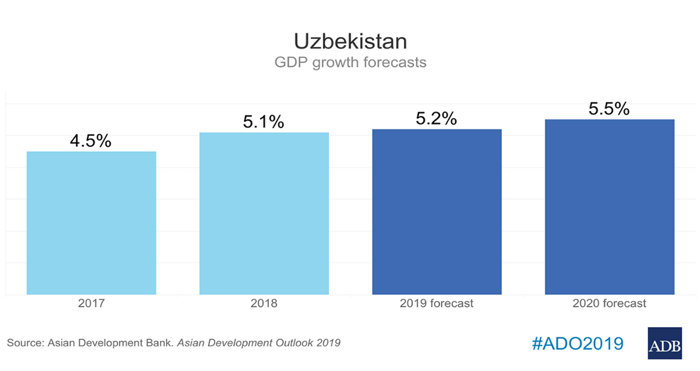

Uzbekistan, the centre of central Asia, is the historical centre of trade, business and tourism since ancient time. The country is one of the most important of location for the historical silk route.

President Shavkat Mirzioyoyev has a vision to transform Uzbekistan into a world class apparel manufacturing location enriched with a strong textile background.

Potential in Growth

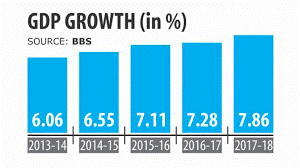

The Gross Domestic Product (GDP) in Bangladesh was worth 302.57 billion US dollars in 2019, according to official data from the World Bank and projections from Trading Economics. The GDP value of Bangladesh represents 0.25 percent of the world economy.

https://tradingeconomics.com/bangladesh/gdp

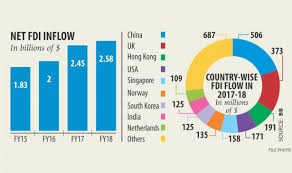

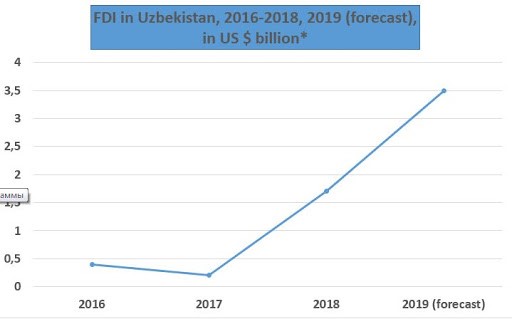

FDI Flows and Stock

According to the UNCTAD’s World Investment Report 2020, FDI inflows to Bangladesh fell by 56% to USD 1,6 billion in 2019 (compared to USD 3,6 billion in 2018).

Total FDI stock was estimated USD 16,4 billion in 2019 by the UNCTAD.

The main assets of Bangladesh’s economy are:

- Good macroeconomic stability characterized by a high growth rate of 7.1% in 2017 (Business France, 2018) and a satisfactory level of public debt

- An open and diverse economy

- A very low-cost workforce

- A strategic geographic position as a gateway to countries in the Asia-Pacific region

- A strategic and competitive position in the value chain of the global economy

- An economic and legislative environment globally favorable to business

The main obstacles to attracting investment include:

- A business environment complicated by the country’s weak infrastructure, burdensome bureaucracy, rampant corruption, lack of transparency and the slow pace of the judicial system

- Exports that are not sufficiently diversified and highly dependent on the textile sector

- Weakness of the financial sector

- Vulnerability to natural disasters (cyclones, severe floods) that result in substantial income losses

https://www.nordeatrade.com/en/explore-new-market/bangladesh/investment

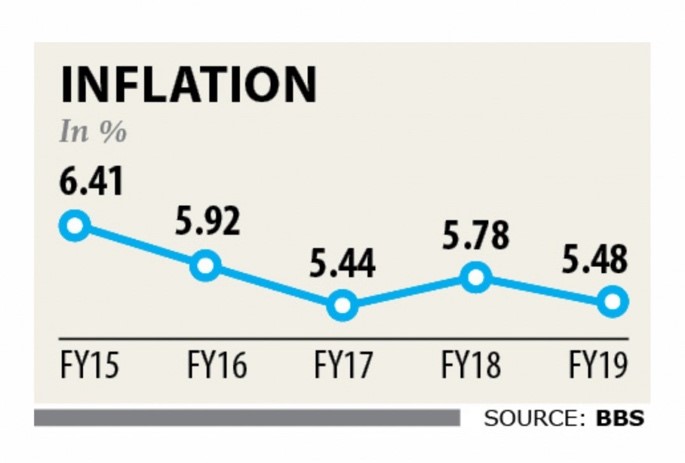

Inflation

The annual inflation rate in Bangladesh rose to 6.02 percent in June of 2020 from 5.35 percent in May which was the lowest rate since December of 2018, as demand improved with the easing of lockdown restrictions.